Blog

Year-End: Is Your Business Ready?

As the year comes to a close, it’s the perfect time to make sure your business insurance still matches the way you operate. A quick year-end review can help you catch gaps, update important details...

Read more

Fireplace Safety: How to Keep Your Home Warm and Protected This Winter

There’s nothing quite like relaxing by a warm fireplace during the colder months. But while fireplaces add comfort and charm to a home, they also come with risks if they aren’t used properly. At...

Read more

Understanding Long-Term Care and Life Insurance: Planning for Peace of Mind

When it comes to planning for the future, few topics are as important, and often overlooked, as long-term care. Whether it’s assisted living, in-home care, or memory care, the costs of long-term...

Read more

Celebrating National Notary Day: Why Notary Bonds Matter

November 7th is National Notary Day, a day to recognize the essential role notaries play in our communities. From witnessing signatures on legal documents to ensuring the integrity of important...

Read more

Kicking Off our Third Annual Food Drive!

We’re proud to kick off our Third Annual Food Drive in support of Grace Resources, a local nonprofit dedicated to providing food, shelter, and support to individuals and families in need throughout...

Read more

Cybersecurity Awareness Month: How Cyber Insurance Protects Your Business

October is Cybersecurity Awareness Month, a great time to take stock of your business’s cyber defenses. While strong passwords, multi-factor authentication (MFA), regular software updates, and...

Read more

Our Bicycle Program Team is Visiting Boise!

Our Bicycle Program team is heading to Boise, ID on October 23rd & 24th to meet with local bike shops, builders, and manufacturers! We’re excited to share how our Bicycle Business Insurance Program...

Read more

Peace of Mind on the Road: Our New Mechanical Protection Coverage

At the ISU Stephen B. Marvin Agency, we’re always looking for ways to provide more value and protection to our clients. That’s why we’re excited to introduce a new coverage option now available...

Read more

Celebrating National Construction Appreciation Week

This week marks National Construction Appreciation Week. A time to recognize the hardworking men and women who design, build, and maintain the structures that keep our communities thriving. From...

Read more

Our Giving Garden Has Bloomed 🌱

This year, our summer fundraiser, The Giving Garden, was a tremendous success, and none of it would have been possible without the generosity and effort of our team, clients, and community....

Read more

See You at the MADE Bike Show in Portland, OR!

ISU Stephen B. Marvin Insurance is Heading to the MADE Bike Show in Portland!We’re excited to announce that ISU Stephen B. Marvin Insurance will be attending the MADE Bike Show in Portland, Oregon...

Read more

Insuring the Bicycle Industry: How We Support Bike Shops, Builders, and More

At ISU Stephen B. Marvin Insurance Agency, we understand that no two industries are exactly alike, and that’s especially true for the bicycle world. Whether you're a local bike shop, a custom frame...

Read more

🌼 The Giving Garden Fundraiser Is Here! 🌼

Growing Good Things for Grace Resources We’re excited to announce that our annual summer fundraiser, The Giving Garden, is officially live! From now through August 22nd, we’re coming together as an...

Read more

The Ultimate New Homeowner Checklist

Happy New Homeowners Day! 🏡 May 1st is a day to celebrate all those who have recently purchased a home - congratulations! Whether you’re settling into your first home or upgrading to a new space,...

Read more

Why Life Insurance Belongs in Your Financial Plan

April is Financial Literacy Month. A time to focus on smart money management, from budgeting and saving to investing and planning for the future. But one crucial piece of financial literacy is...

Read more

National Pet Insurance Day: Is Your Pet Covered?

Every pet owner wants the best for their furry friend, but have you ever thought about how you’d handle an unexpected vet bill? April 7th is National Pet Insurance Day, a perfect reminder to...

Read more

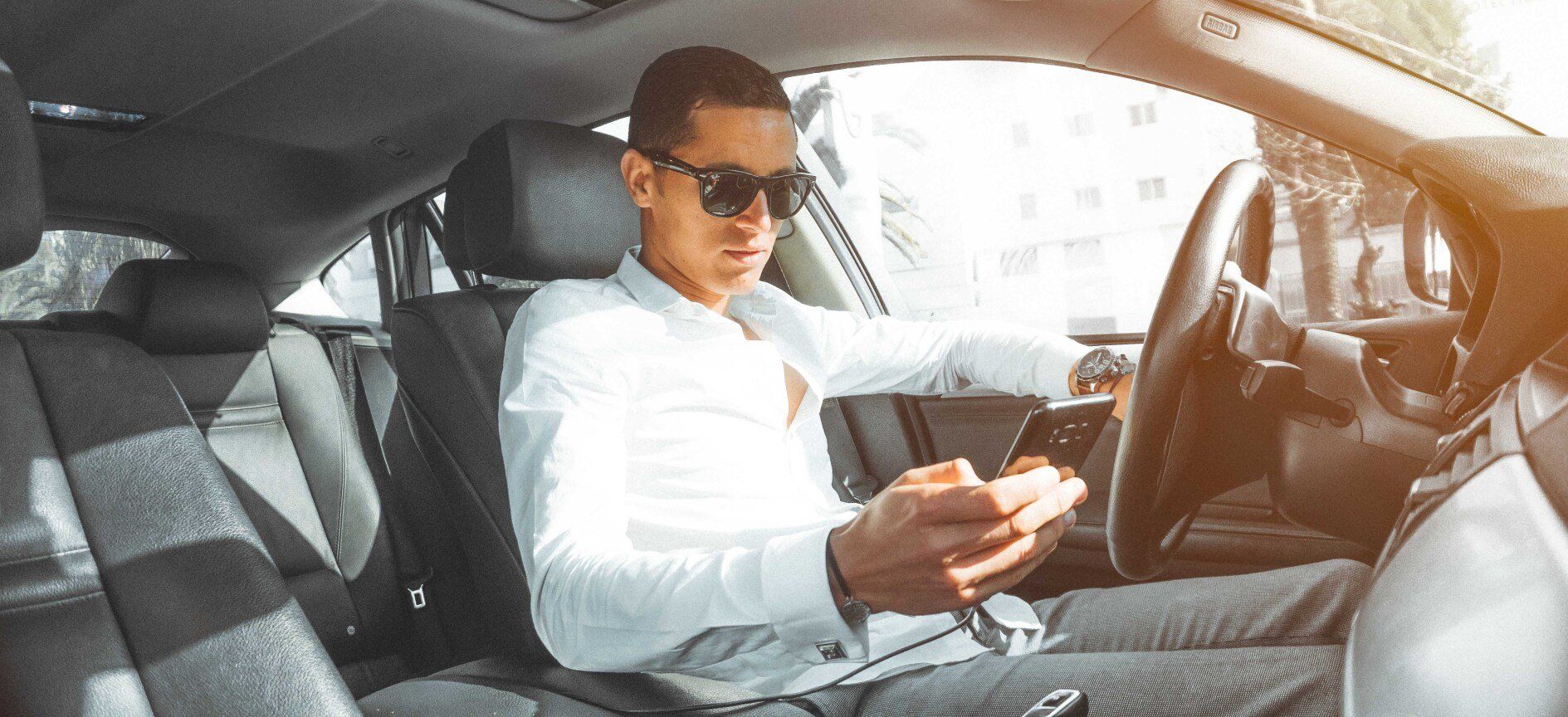

Drive Now, Text Later: The Truth About Distracted Driving

Every day, distracted driving puts countless lives at risk. Whether it's glancing at a text message, adjusting the radio, or grabbing a quick bite on the go, these small distractions can lead to...

Read more

Spring Home Maintenance Tips to Protect Your Home

Spring is here, and as the weather warms up, it's the perfect time to tackle home maintenance tasks that can help keep your home safe and in top condition. Seasonal maintenance not only helps...

Read more

Expanding Our Legacy: ISU Stephen B. Marvin Insurance Agency Opens in Eagle, Idaho

Since 1912, the ISU Stephen B. Marvin Insurance Agency has been a trusted name in insurance. We’re excited to continue that legacy with the opening of our new office in Eagle, Idaho! This expansion...

Read more

Meet Us at CABDA West – Your Bike Shop Insurance Specialists!

We’re excited to announce that ISU Stephen B. Marvin Insurance will be attending CABDA West in Las Vegas, on March 26th & 27th, 2025! This premier event is the perfect opportunity for bike shop...

Read more

Tips for Driving Safe in School Zones

Driving Safely in School Zones As the school year gets into full swing, it's important to remember that school zones demand extra diligence and care from drivers....

Read more

Home Insurance and Aerial Inspections

This is a subtitle for your new post The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your...

Read more

Are You Insuring Your Property Correctly?

This is a subtitle for your new post Understanding the Difference: Landlord, Home & Short-Term Rental Insurance. Protect your property the right way with...

Read more

Consider Employment Practice Liability Insurance (EPLI) for Your Business

Employment Practices Liability Insurance (EPLI) Several of our business clients have been impacted by a wrongful termination lawsuit that nearly put them out of business, and I...

Read more

Distracted Driving Awareness Month

April is Distracted Driving Awareness Month April is Distracted Driving Awareness Month, and it's the perfect time to refresh our commitment to safe driving. Here's how we can...

Read more

Why Should You Consider Pet Insurance?

April 7th is National Pet Insurance Day. April 7th is National Pet Insurance Day! We know that your furry friends are very important, and here are some reasons why you should...

Read more

Celebrate National Umbrella Month This March With Extra Protection

As we step into the vibrant season of spring, it's not just the flowers that bloom, but also the anticipation of unpredictable weather. With March marking the National "Umbrella Month," it’s a...

Read more

Understanding the Rise in Insurance Premiums

Navigating the insurance landscape has become increasingly challenging for many, with noticeable upticks in premiums across various policies. At ISU Stephen B. Marvin Insurance Agency, we...

Read more

Ensuring the Safety of Your Treasured Gifts: A Quick Guide to Supplemental Coverage

I trust this message finds you well and that the beginning of 2024 has brought joy and positivity to your life. As we embark on a new year, I wanted to address a common concern that arises among...

Read more

Secure Your Business: Cybersecurity Measures for Remote Work

The past few years have reshaped the landscape of work, and remote operations have become a cornerstone of many businesses. While the necessity for remote work may have evolved, the importance of...

Read more

The Importance of Long-Term Care Insurance

In the hustle and bustle of daily life, it's easy to take for granted our ability to complete simple tasks like bathing, eating, and dressing. However, as we age, the risk of losing these basic...

Read more